Mastering Linux: Your Ultimate Guide

Explore the world of Linux with expert tips and tutorials.

Battle of the Quotes: Finding Your Perfect Insurance Match

Discover how to find your ideal insurance match in our ultimate quote showdown! Uncover the best options for your needs today.

Top 5 Quotes to Consider When Choosing Your Insurance Plan

Choosing the right insurance plan can be a daunting task, but reflecting on insightful quotes can guide your decision-making process. "An ounce of prevention is worth a pound of cure" is a reminder that investing in the right insurance early on can save you from significant financial turmoil later. Additionally, "Insurance is like marriage. You pay, pay, pay, and you never get anything back" highlights the importance of understanding what you're truly getting in return for your premiums. Here are the top five quotes to consider when selecting your insurance plan:

- "The best time to buy insurance is when you don’t need it." – This emphasizes the importance of preparation.

- "In this world, nothing is certain but death and taxes." – A reminder to secure your family’s future.

- "It’s not how much you make but how much you keep that matters." – Refers to choosing plans that protect your assets.

- "Insurance is a safety net, not a solution." – Understanding its purpose is crucial.

- "You can't predict the future, but you can plan for it." – Encouraging proactive measures in planning your insurance.

Understanding Insurance Options: A Comprehensive Guide for Consumers

Understanding insurance options can be daunting for many consumers, but it's essential for protecting your financial well-being. Insurance can be divided into various categories, including health insurance, auto insurance, homeowners insurance, and life insurance. Each of these options serves a unique purpose, addressing different risks and needs. For instance, health insurance provides coverage for medical expenses, while auto insurance safeguards against losses related to vehicles. To navigate through these options effectively, it's crucial to compare plans, assess coverage limits, and understand policy exclusions.

When considering your insurance options, it's helpful to follow a systematic approach. Begin by evaluating your personal circumstances, including your assets, liabilities, and potential risks. Next, create a list of necessary coverages and prioritize them based on your lifestyle and financial situation. For example, individuals with dependents may prioritize life insurance to secure their loved ones' future, whereas homeowners might focus on homeowners insurance to protect their property. Ultimately, taking the time to understand your needs and thoroughly researching available policies will empower you to make informed decisions tailored to your circumstances.

How to Evaluate Insurance Quotes: What to Look For

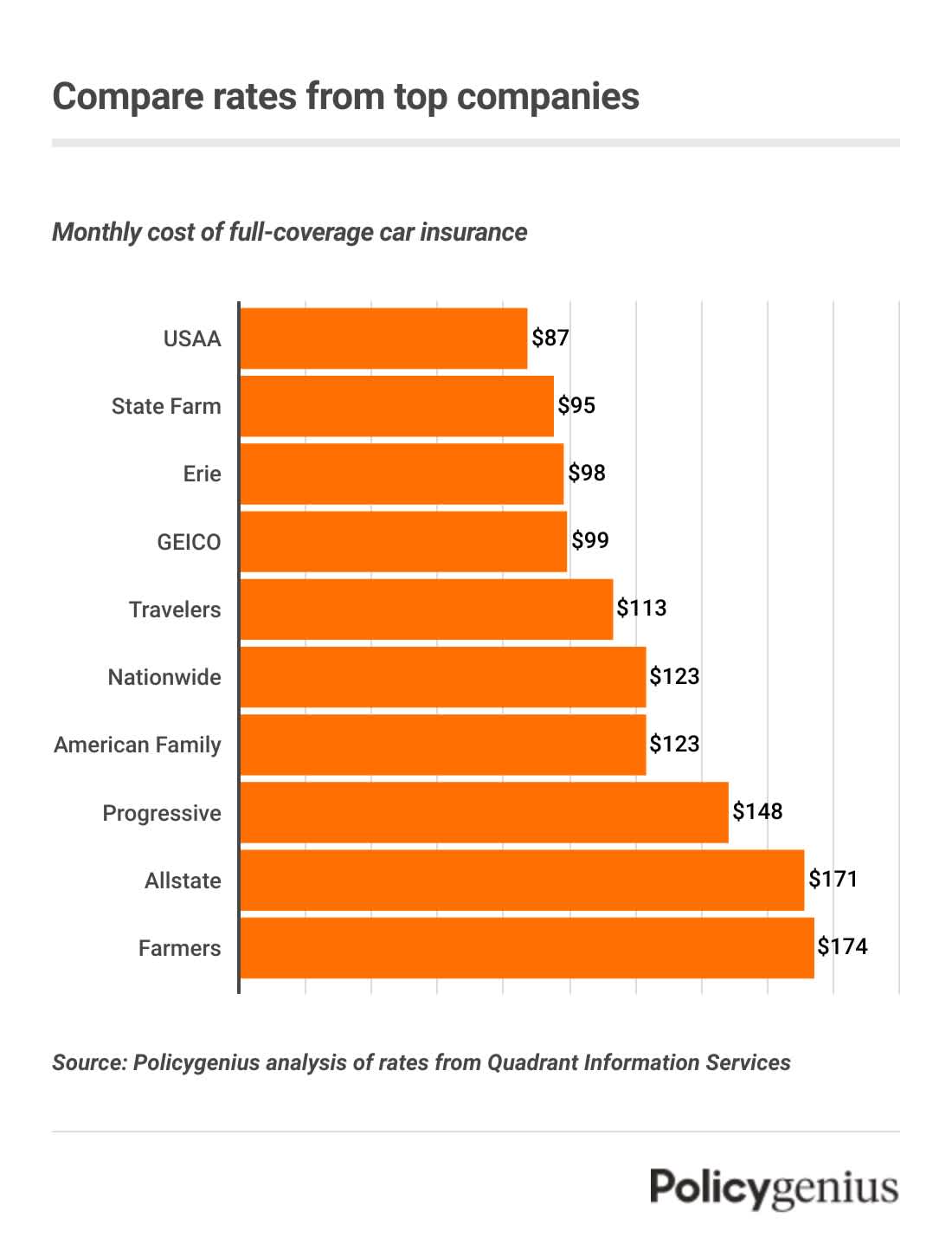

When evaluating insurance quotes, it is crucial to focus on several key factors that directly impact your coverage and overall cost. Start by comparing the premium amounts; however, a low premium may often come with reduced coverage. Next, examine the deductibles associated with each policy. A higher deductible can lower your premium, but make sure you're financially able to pay that amount out-of-pocket in the event of a claim. Additionally, assess the coverage limits and verify that they meet your personal needs.

Another important aspect to consider is the reputation and customer service record of the insurance provider. Look for reviews and ratings from existing customers to gauge their experiences. Furthermore, check the policy details for any exclusions or specific terms that may affect your coverage. It can be beneficial to create a simple comparison table to summarize the essential characteristics of each quote, enabling you to make an informed decision. By taking these steps, you'll be better equipped to choose the right insurance policy that balances cost and adequate protection.