Mastering Linux: Your Ultimate Guide

Explore the world of Linux with expert tips and tutorials.

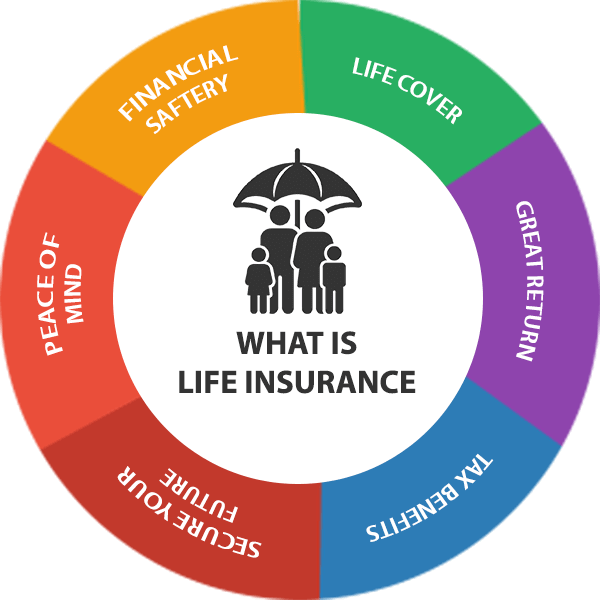

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the ultimate safety net you never knew you needed—secure your family's future today!

Understanding the Basics: How Life Insurance Works

Life insurance is a contractual agreement between an individual and an insurance company that provides financial compensation to beneficiaries upon the insured person's death. The primary purpose of life insurance is to offer a safety net for your loved ones, ensuring they have financial support during a difficult time. There are two main types of life insurance: term life insurance, which covers a specific period, and whole life insurance, which provides coverage for the insured's entire lifetime and typically includes a cash value component.

When you purchase a life insurance policy, you agree to pay a premium, which is the amount you owe to the insurer, either monthly or annually. In return, the insurer promises to pay a designated amount, known as the death benefit, to your beneficiaries when you pass away. The amount of the premium often depends on various factors, including your age, health, lifestyle choices, and the amount of coverage you seek. Understanding these basics can help you make informed decisions about which life insurance product suits your needs and provides the best financial security for your loved ones.

5 Common Myths About Life Insurance Debunked

Life insurance is often surrounded by myths that can lead to misconceptions about its importance and functionality. One of the prevalent myths is that it is only necessary for those with dependents. In reality, life insurance can provide financial security for anyone, including singles, as it can cover debts, funeral costs, and even serve as a financial legacy.

Another common myth is that life insurance is prohibitively expensive. Many people believe they can't afford it, but the truth is there are various types of policies available to fit different budgets. Term life insurance, for instance, tends to be more affordable than whole life policies, and securing coverage at a younger age can significantly lower premiums. It's crucial to evaluate your options and recognize that life insurance can be a valuable investment in financial protection.

Is Life Insurance Right for You? Key Questions to Consider

When considering whether life insurance is right for you, it's crucial to evaluate your individual circumstances and financial goals. Start by asking yourself these key questions:

1. Do you have dependents who rely on your income?

2. What debts or financial obligations would need to be covered in the event of your passing?

3. Do you have a plan for your funeral expenses?

Understanding the answers to these questions can help you determine the necessity and extent of life insurance coverage in your financial planning.

Another important factor to consider is your current and future financial situation. Reflect on the following:

1. Are you in a stable financial position that allows for monthly premium payments?

2. Will your financial needs change over time, such as starting a family or buying a home?

3. Have you explored the different types of life insurance, such as term versus whole life policies?

By carefully assessing these aspects, you can make a more informed decision about whether life insurance is a suitable choice for you and your loved ones.