Mastering Linux: Your Ultimate Guide

Explore the world of Linux with expert tips and tutorials.

Crypto Regulation Roulette: What’s Spinning in the Legal Landscape?

Discover the wild twists of crypto regulations! Uncover what’s spinning in the legal landscape and how it impacts your investments.

Understanding the Global Landscape of Crypto Regulations: Key Players and Policies

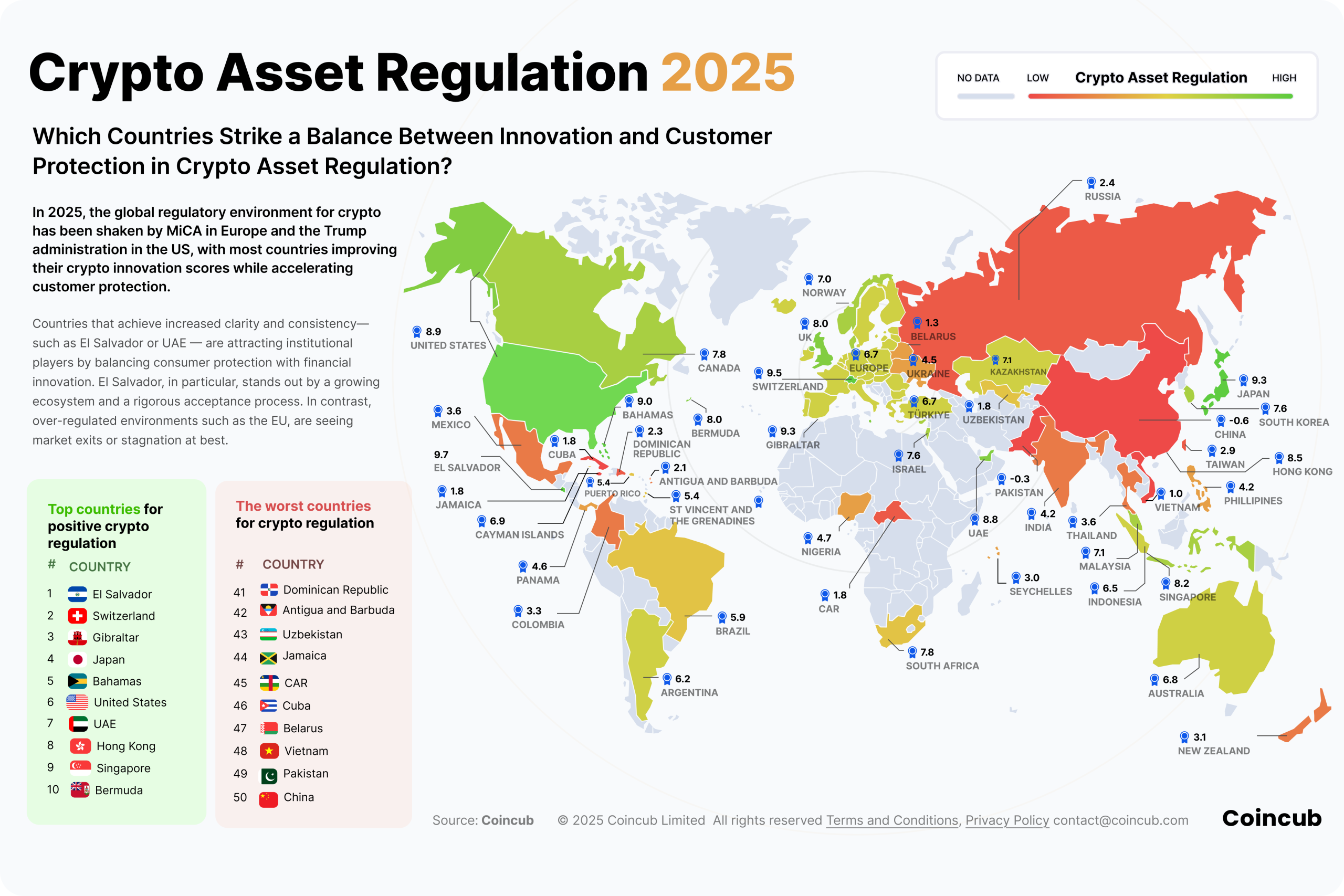

The global landscape of crypto regulations is a complex and rapidly evolving field. As cryptocurrencies gain traction, various nations are taking distinct approaches to regulate them, influenced by local economic conditions, technological advancements, and political climates. Key players in this regulatory environment include the United States, the European Union, and Asia-Pacific countries such as China and Japan. Each of these jurisdictions is drawing up its own policies, which can create a fragmented regulatory environment and significant compliance challenges for global cryptocurrency firms.

Among the pivotal policies observed around the world, taxation laws, anti-money laundering (AML) guidelines, and security regulations stand out. For instance, the Financial Action Task Force (FATF) has set international standards aimed at combating money laundering and terrorist financing, pushing countries to implement strict AML regulations for cryptocurrencies. Meanwhile, the U.S. Securities and Exchange Commission (SEC) is rigorously evaluating whether certain cryptocurrencies should be classified as securities, which would subject them to stricter regulatory oversight. As these policies evolve, understanding them is essential for stakeholders aiming to navigate the intricate web of global cryptocurrency regulation.

Counter-Strike is a popular first-person shooter game that emphasizes teamwork, strategy, and skill. Players can engage in intense matches, often involving objectives like bomb defusal or hostage rescue. For those looking to enhance their gaming experience, checking out the betpanda promo code can offer some exciting bonuses and rewards.

How Recent Regulatory Changes Affect Cryptocurrency Investments

The world of cryptocurrency has been significantly impacted by recent regulatory changes, which have created both challenges and opportunities for investors. Many countries are tightening their regulations to address concerns about market volatility, anti-money laundering, and consumer protection. For instance, the European Union has introduced stricter compliance measures that require cryptocurrency platforms to report transaction data and verify user identities. These measures aim to enhance market stability and protect investors, but they may also limit the operational flexibility of various exchanges.

Moreover, the regulatory landscape is constantly evolving, which adds an element of uncertainty for those looking to invest in cryptocurrencies. Investors must stay informed about new policies, as regulations can significantly affect market dynamics and overall investment strategies. In response to the new laws, many investors are reevaluating their portfolios and considering how to adapt to maintain compliance while maximizing gains. As the regulatory environment continues to change, it will be crucial for investors to remain vigilant and agile in their approach to cryptocurrency investments.

What Are the Common Legal Challenges Faced by Crypto Startups?

As the cryptocurrency landscape continues to evolve, crypto startups face a myriad of legal challenges that can hinder their growth and operational efficiency. One major concern is compliance with securities regulations. Depending on the jurisdiction, various tokens may be classified as securities, which subjects them to rigorous reporting and registration requirements. Failure to comply can lead to hefty fines and legal action from regulatory bodies, making it crucial for startups to stay informed about the laws that govern their specific digital assets.

Another significant challenge is navigating the complex landscape of anti-money laundering (AML) and know your customer (KYC) regulations. Crypto startups are required to implement stringent measures to prevent illicit activities, including thorough verification of their users' identities. Non-compliance can result in penalties or even the suspension of operations. Additionally, intellectual property issues arise, particularly concerning software patents and copyright protections, which can complicate innovation in an already turbulent market.