Mastering Linux: Your Ultimate Guide

Explore the world of Linux with expert tips and tutorials.

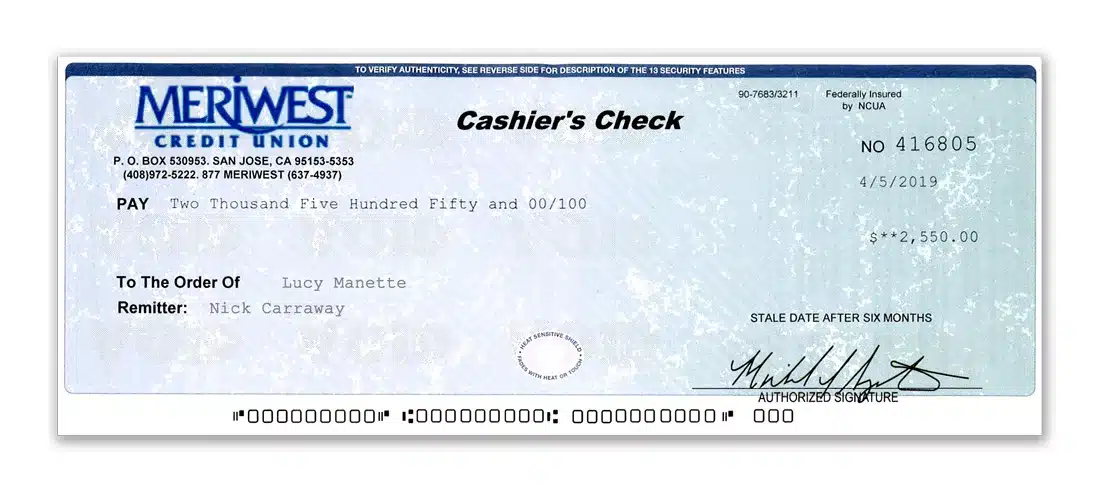

Fair Play or Fraud Play? Navigating the Fine Line in Digital Transactions

Explore the murky waters of digital transactions—are you playing fair or falling for fraud? Uncover the truth now!

Understanding the Impact of Digital Fraud on Fair Play in Transactions

In today's digital landscape, digital fraud poses a significant threat to the integrity of online transactions. As businesses increasingly rely on digital platforms, they become more vulnerable to various forms of fraud, including identity theft, phishing, and payment fraud. The impact of these malicious activities is profound, as they undermine trust between consumers and businesses. According to a report by the PYMNTS, over 40% of online shoppers have experienced some form of digital fraud, highlighting the urgent need for improved security measures to restore confidence in fair play during transactions.

The consequences of digital fraud extend beyond individual transactions. They can lead to increased compliance costs for businesses and a deteriorating reputation, resulting in lost sales and customer loyalty. To combat this issue, companies must implement robust security protocols, such as two-factor authentication, end-to-end encryption, and continuous monitoring of transaction patterns. By prioritizing security, businesses can foster a safer online environment, ensuring that fair play remains at the forefront of all digital transactions.

To get the best deals and offers on your favorite games, don't forget to check out the duel promo code available right now!

10 Warning Signs of Fraudulent Activity in Online Payments

Online payment fraud is a growing concern, and recognizing the warning signs is essential for safeguarding your finances. First, be wary of unexpected charges on your account. If you notice unfamiliar transactions, it could indicate that your payment information has been compromised. Additionally, keep an eye out for phishing emails that appear to be from legitimate companies, requesting personal or financial information. These emails often contain links that lead to fraudulent websites designed to capture your sensitive data.

Another critical red flag is when a website offers products at unusually low prices. If a deal seems too good to be true, it often is. Furthermore, check for poor website design or signs of a lack of professionalism, such as many spelling or grammatical errors. Lastly, be cautious if a merchant pressures you to act quickly on a purchase, or if they lack clear contact information. All these factors can serve as indicators of potential fraudulent activity in online payments.

How to Ensure Fairness in Digital Transactions: Best Practices

In today's digital landscape, ensuring fairness in transactions is paramount for building trust and maintaining a strong reputation. One of the best practices to achieve this is by implementing transparent pricing models. Clear communication about fees, charges, and terms of service minimizes misunderstanding and helps users make informed decisions. Additionally, employing secure payment gateways that comply with industry standards is essential to protect sensitive information and foster confidence among consumers. Regular audits of transaction processes are also recommended to identify and rectify any potential biases or discrepancies that may occur.

Another effective strategy is to adopt a user-centric approach in your platform's design and functionality. This involves creating intuitive interfaces that ensure ease of use for all customers, regardless of their background or technical expertise. Incorporating feedback mechanisms allows users to voice their concerns, further promoting fairness and inclusivity. Finally, actively training staff and stakeholders about the importance of equitable practices in digital transactions can drive a culture of fairness, ensuring that all operational aspects align with your commitment to fairness.